Mahila Samman Bachat Patra Yojana 2024: Overview, Interest Rate, Rules, and Benefits

Introduction to Mahila Samman Bachat Patra Yojana

The Mahila Samman Bachat Patra Yojana was announced by Finance Minister Nirmala Sitharaman in the budget for 2023–24. This initiative allows Indian women and girls to open accounts at post offices, offering a fixed annual interest rate of 7.5% on deposits up to Rs. 2 Lakhs.

- Duration: The scheme is effective for two years, from February 1, 2023, to March 31, 2025.

- Investment Range: Minimum deposit is Rs. 1000, with a maximum of Rs. 2 Lakhs.

For comprehensive information on applying, eligibility, and required documents, continue reading.

Key Features of Mahila Samman Bachat Patra Yojana

- Scheme Name: Mahila Samman Bachat Patra Yojana

- Objective: To empower women by promoting saving and investment habits.

- Sector: Indian Government

- Ministry: Ministry of Finance

- Status: Active

- Beneficiaries: All women in India

- Application Process: Offline

- Official Website: indiapost.gov.in

- Helpline Number: 1800 180 6127

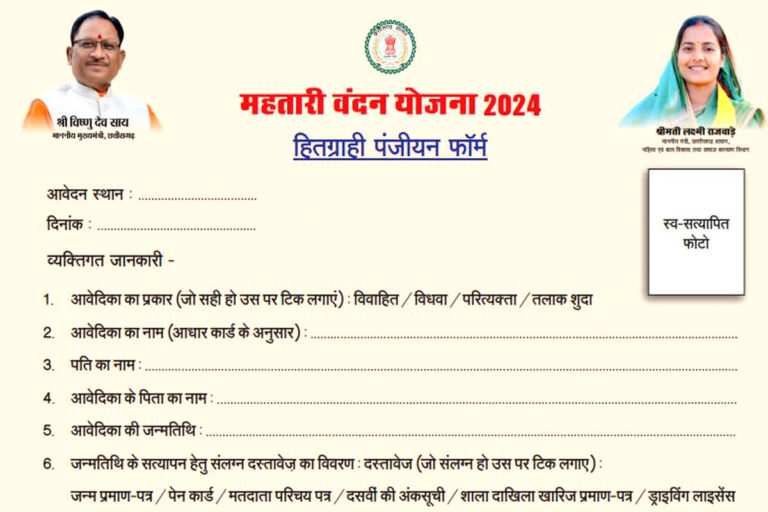

Required Documents for Application

To apply for the Mahila Samman Bachat Patra Yojana, the following documents are necessary:

- Aadhar card of the applicant

- Passport-sized photograph

- Mobile number

- PAN card

- Caste certificate

- Identity card

- Ration card

- Residence certificate

Benefits of Mahila Samman Bachat Patra Yojana

- High Interest Rate: Earn a significant interest amount on a small investment with a 7.5% interest rate, which is higher than many other savings schemes.

- Investment Flexibility: Women can invest up to Rs. 2 Lakhs in one go or through installments.

- Account Withdrawal: After one year, a maximum of 40% of the deposit amount can be withdrawn if needed.

- Principal Return: Both the principal and interest will be returned after the two-year term.

- Minor Accounts: A guardian is required to open an account for a minor girl.

Eligibility Criteria

To qualify for the Mahila Samman Bachat Patra Yojana, applicants must meet the following criteria:

- Must be an Indian citizen and a woman.

- The family’s maximum income should not exceed Rs. 7 Lakhs.

How to Apply for Mahila Samman Bachat Patra Yojana

- The scheme is currently available in 1.59 Lakhs post offices.

- Steps to Apply:

- Visit your nearest post office to obtain the application form.

- Fill out the form and attach the required documents.

- Submit the completed form and deposit your chosen amount (between Rs. 1000 and Rs. 2 Lakhs) via cheque or cash.

- After depositing, you will receive a receipt for your investment.

Additionally, the following banks also offer the Mahila Samman Bachat Patra Yojana:

- Punjab National Bank

- Bank of India

- Bank of Baroda

- Canara Bank

Frequently Asked Questions (FAQ)

- What is Mahila Samman Bachat Patra Yojana?

It is a government scheme that provides a fixed 7.5% interest rate on deposits ranging from Rs. 1000 to Rs. 2 Lakhs for two years. - Can accounts be closed before two years?

Yes, accounts can be closed after six months, but the interest will be at 5.5% instead of 7.5%. - How much should be deposited?

The minimum deposit is Rs. 1000, and the maximum is Rs. 2 Lakhs.